Supply and demand – what are the energy trends in the years to come?

The defining character of electricity is that consumption and demand must constantly remain in balance. Electricity is also a challenging form of energy to store in large quantities. Increased capacity, unpredictable wind and concentrated solar power systems on the rise will require the utilization of storage methods. Still and dark times will need to be balanced with on-demand electricity production, such as gas-fired production. What will define the prices, what will the European energy situation look like and what factors will be important for the upcoming winter?

Major investments in wind and solar power in Germany and Nordics while predictable nuclear production in the big power consumption Germany has been decommissioned. The plan in Germany was to rely on cheap and on-demand natural gas during the transition period towards renewables. The challenging situation in Europe caused both gas and electricity prices to shoot up last year which translated into two things: accelerated investments in renewable power production and increased coal usage. According to International Renewable Energy Agency (IRENA), Germany is already the third biggest in wind power capacity, behind China and the USA, but ahead of India. In solar power capacity, Germany ranks 5th in the world, behind China, Japan, the USA and India.

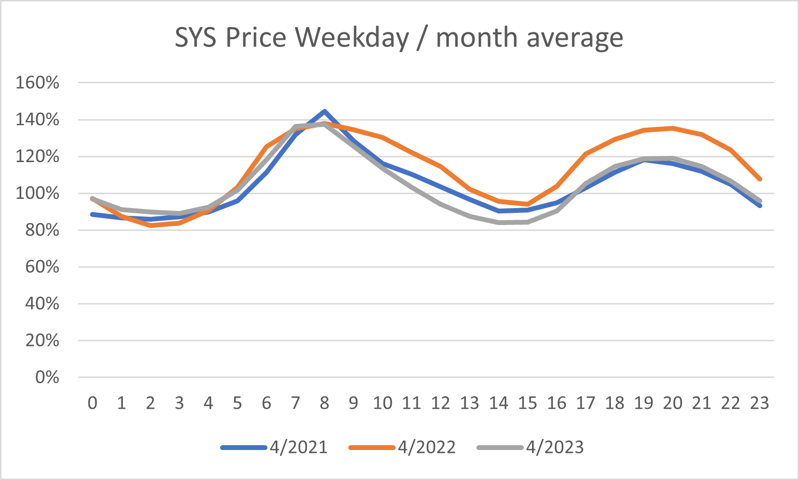

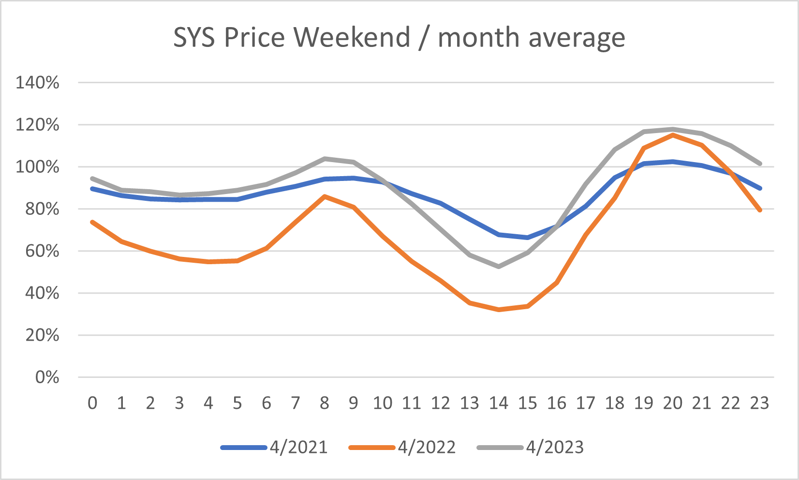

Regarding the Nordics, electricity pricing remains isolated in some regards, even with added transmission capacity towards Central Europe and the UK. Defining characters are a significant amount of hydropower and wind power capacity, and nuclear capacity as baseload production. Spot prices vary a lot along depending on the amount of wind power production; when it’s very windy locally and transmission capacities are in balance with neighboring price areas, the price tends to drop, and vice versa. When there is low wind and high demand, prices may rise sharply either to make consumption fall or to be able to import additional electricity from other areas such as Germany. Furthermore, when there is low demand, like during weekends, and abundant solar power production both in the Nordics and in Germany, prices may drop very low during the day.

The calculated relationship between money earned by constant baseload production and money earned by a specific production method producer - we call profile risk. It may be positive, like in the case of adjustable hydropower producers, or negative, as is increasingly the case for wind power producers. The profile risk is now, alongside the balance risk that comes from unpredictable production and on top of the expected average annual electricity price, the main input when making investment calculations for solar and wind power production. On the flipside, the volatility and character of the production portfolio also supports investments in ways to balance the situation; batteries and pumped storage to store energy, electric boilers to be used during times of very low electricity prices or downregulation and virtual power plants and flexible demand to react to high prices and upregulation. All of these are established technologies when market conditions are considered to be right for the investments. The hot potato on the market in the near future seems to be hydrogen and other forms of using electricity to produce fuels. However, these are predominantly something not reachable at scale before 2026, just like new nuclear capacity in the form of small modular reactors or something else.

The volatility of power production and renewable energy needs must soon be met through more conventional methods that can be rapidly deployed. During the past year we’ve seen French nuclear plants struggling with corrosion issues and low river water levels, consequently making the rivers too warm to use for cooling at full capacity. We also saw natural gas prices peaking in the autumn, but fortunately we had a mild winter. Regarding gas storage in Europe, since the injection season this year started with inventories more than half full, low demand has put downward pressure on near-term prices and inventories are likely to be replenished for the winter already during the summer. The hydro balance situation in the Nordics seems to be slightly drier than normal for the time of year.

Concerning the electricity and gas market for the coming winter, the main questions are how cold next winter will be and whether competing Asian demand picks up for liquified natural gas (LNG), on which Europe’s gas supply now heavily depends, and how much French nuclear capacity will be available. Before considering forecasting anything, also the fallout of an economic downturn may push the balance through canceled investments and less demand. Uncertainty and volatility, however, are guaranteed.

The writer, Eerik Ekström works as an energy market analyst for Gasum Portfolio Services Oy, which provides independent analysis and portfolio management under license issued by the Finnish Financial Supervisory Authority.

The following graphs show the monthly average spot price for each hour divided by the full month average. SYS refers to Nord Pool System price, which is a price calculated daily during the previous day for a certain Nordic area based on the bids and offers, to present the theoretical price level that all the areas would have if there was unlimited transmission capacity within the area. April for past 3 years has been taken as an example of relatively strong solar and wind power production, some annual nuclear maintenance outages and reasonably low heating demand. Prices may be already seen to drop during the daytime, despite daytime demand, with strong solar power production in the system. Data source: SKM Syspower, analyzed by Gasum Portfolio Services