Navigating the currents of the Energy Markets

In the world of energy, change is constant. While day-ahead markets have become familiar territory for consumers, it's crucial to recognize that there are more layers to the energy landscape. Let's dive into the markets beyond the day-ahead and understand their significance for the industry.

Newspaper headlines often make bold predictions of future electricity prices. While it's tempting to make such grand statements, the reality is more nuanced. Today, the Nordic electricity market is shaped by a variety of factors, with one of the emerging key drivers is hydro power potential.

For consumers, the concept of spot prices has gained traction, especially in Finland. Thanks to media coverage, consumers can now easily access next-day price information and adjust their consumption accordingly. However, the spot price isn't a one-size-fits-all metric. It fluctuates based on factors like wind power production and demand, leading to both cheap and expensive hours.

But for larger consumers and producers, the energy market is more complex than spot prices alone. They actively engage in spot markets, adjusting bids and offers based on their strategies. Beyond that, intraday trading comes into play, where real-time data, like weather forecasts and production variances, becomes critical. Prices in intraday markets can significantly deviate from spot prices.

Risk mitigation requires 24/7 market presence

The energy grid must maintain a delicate balance between supply and demand, second by second. Regulation markets are where this balancing act unfolds. Errors in estimating demand or production can result in financial consequences. Smaller consumers typically don't engage in this 24/7 monitoring, but larger companies like Gasum have dedicated control rooms for this purpose. By outsourcing market monitoring to Gasum, even smaller scale companies may gain access for the intraday and regulation markets, mitigating the risks as result.

While volatility is a hallmark of energy markets, flexibility can mitigate risks and unlock opportunities. Production side does not necessarily require wind turbines, virtual power plant is just as effective if established. They consist of smaller consumption devices or batteries that can modulate demand or inject electricity into the grid, akin to conventional power plants.

Diversification is key to navigating volatile markets. Having multiple production methods, such as electric boilers and LNG-boilers, enhances flexibility and market competitiveness. As solar and wind power production expand, flexible baseload production gains value, positioning early adopters for substantial benefits.

Flexibility in electricity market remains crucial

Looking ahead, the next few months are expected to bring relatively lower average spot prices in Finland compared to the past year. However, flexibility remains crucial. The electricity market is evolving, and those who grasp the potential of flexibility will thrive in this dynamic landscape.

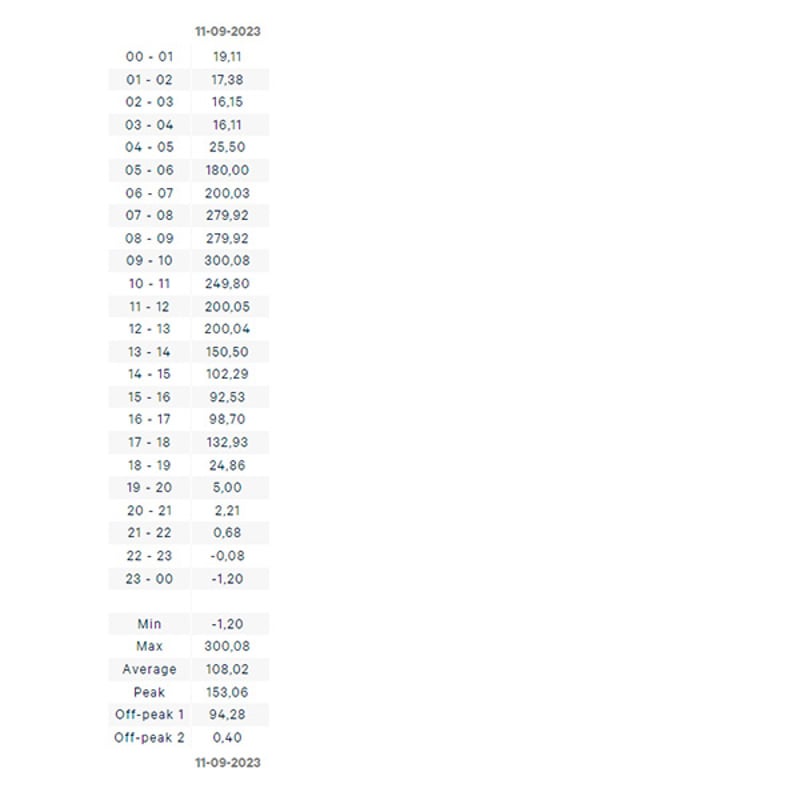

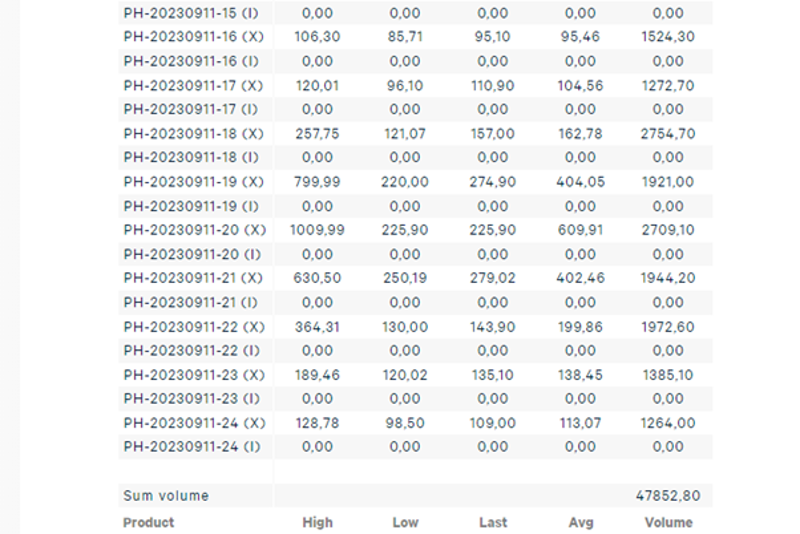

In the ever-evolving energy markets, understanding the nuances of various market layers is essential. For instance, if the consumer had purchased electricity on September 11th, 2023, from the day-ahead markets, 1 MW for the full day, the average price was 108,2 €/MWh. However, after that price was determined, there were changes on the markets, and prices on average on intraday varied between 83,34 €/MWh and 1009,99€/MWh.

So, if one were able to cut the demand, there would have been money to be made on the intraday markets already. This highlights the need to navigate these intricacies as we move forward. From hydro power potential to regulation markets and flexibility, each component plays a role in shaping the energy landscape. Embracing flexibility and understanding these numeric examples will be the key to success in this dynamic and intricate market.

Would you like to get in-depth weekly updates or spot analyses? Sign up through this form.

The writer, Eerik Ekström works as an energy market analyst for Gasum Portfolio Services Oy, which provides independent analysis and portfolio management under license issued by the Finnish Financial Supervisory Authority.

Price sources: